Financial adviser complaints can be avoided

Financial adviser complaints can be avoided, says Insurance & Savings Ombudsman

Insurance & Savings Ombudsman

Karen Stevens says good client communication and clear

processes can help financial advisers prevent client

dissatisfaction.

“We deal with over 3000 complaint enquiries each year and only a small number relate to financial advisers,” says Insurance & Savings Ombudsman Karen Stevens. “Mostly, we are contacted about insurance issues including house, motor vehicle, contents, life or health insurance.

“But the complaint enquiries we do receive about financial advisers tend to be about the quality of advice, miscommunication, misunderstandings, fees and charges.

“The good thing is many of these issues can be avoided if financial advisers have robust processes, check details, and communicate clearly and regularly with their clients,” says Karen.

“In one case, an adviser didn’t inform his client’s insurance company that his client hadn’t been smoking for 12 years. Therefore his life insurance premiums were higher than they should have been. The client mistakenly thought it was his adviser’s responsibility to inform his insurer of the change in his smoking. This highlights how important it is for advisers to describe their role and regularly communicate with clients. It also demonstrates how many clients do not understand what their obligations and responsibilities are.

“Another adviser filled out a health insurance application on behalf of her client, and omitted to declare details about their ongoing health issues. When the insurance claim was declined due to non-disclosure, the client said it was his adviser’s mistake.

“It’s wise for financial advisers to ensure their customers complete application forms, and to make sure their clients are fully aware of the duty of disclosure and the potential consequences of failing to disclose information.”

Complaints are valuable feedback for industry. “Rob Everett, Chief Executive of the FMA, recently described complaint data as ‘gold-dust’. We agree. We regularly share complaint information with our members through regular newsletters and training webinars,” says Karen.

“We base our training on real complaints and issues. We want to ensure lessons can be learnt from past mistakes, and business practices can be improved, so everyone benefits.”

ends

Business Canterbury: Urges Council To Cut Costs, Not Ambition For City

Business Canterbury: Urges Council To Cut Costs, Not Ambition For City Wellington Airport: On Track For Net Zero Emissions By 2028

Wellington Airport: On Track For Net Zero Emissions By 2028 Landcare Research: ANZAC Gall Fly Release Promises Natural Solution To Weed Threat

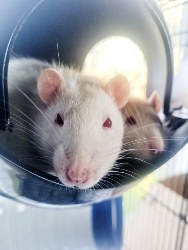

Landcare Research: ANZAC Gall Fly Release Promises Natural Solution To Weed Threat NZ Anti-Vivisection Society: Auckland Rat Lovers Unite!

NZ Anti-Vivisection Society: Auckland Rat Lovers Unite! University of Canterbury: $1.35 Million Grant To Study Lion-like Jumping Spiders

University of Canterbury: $1.35 Million Grant To Study Lion-like Jumping Spiders Federated Farmers: Government Ends War On Farming

Federated Farmers: Government Ends War On Farming