GMT Reports Resilient Result

GMT Reports Resilient Result

Goodman (NZ) Limited, the manager of Goodman Property Trust (“GMT” or “Trust”) is pleased to announce the Trust’s annual result for the year ended 31 March 2010.

Summary

+ After tax operating earnings of $77.5 million or 9.10 cents per unit.

+ Before tax profit of $12.5 million compared to a loss of $83.7 million in the previous corresponding period.

+ An after tax loss of $7.0 million and adjusted NTA of $0.99 per unit compared to a loss of $74.1 million and adjusted NTA of $1.06 per unit last year.

+ Current gearing of 37.0% with an interest cover ratio of 2.5 times.

+ Successful $150 million issue of BBB+ rated Goodman+Bonds.

+ Asset sales of $53.3 million.

+ Continuing success in its development programme with three new development commitments, totalling $39.6 million, secured from leading customers Kmart, IBM NZ and Ingram Micro New Zealand.

+ 114,326 sqm of new leasing transactions helped maintain portfolio occupancy at 96% and the average lease term of 5.8 years.

Financial Result

The steady performance of GMT’s investment portfolio contributed to another sound operating result. Net property income increased 2.4% to $106.2 million while operating earnings before tax increased by 3.1% to $99.4 million. The increase includes the contribution from completed development projects and steady rental growth partially offset by two asset sales and a small reduction in portfolio occupancy during the year.

The impact of higher interest costs, following the Trust’s successful corporate bond issue and earlier refinancing activity, contributed to the 7.5% reduction in after tax operating earnings to $77.5 million. On a weighted average unit basis, operating earnings were 9.10 cents per unit which is consistent with the guidance provided in May 2009.

While operating earnings are within the guidance range, a devaluation of 3.3% across the property portfolio and movements in other non-operating items has impacted on reported profit.

Profit before tax was $12.5 million compared to last year’s loss of $83.7 million. The relative improvement is mainly attributable to the smaller portfolio devaluation recorded in 2010. Movements in the deferred tax charge have contributed to an after tax loss of $7.0 million compared to a reported loss of $74.1 million in the previous corresponding period

The devaluation and movements in other non-operating items have no impact on operating earnings but contribute to the reduction in adjusted net tangible assets to $0.99 cents per unit.

Keith Smith, Chairman of Goodman (NZ) Limited said, “GMT is a mature and stable business that has responded to the challenges of tighter credit markets and a more subdued economic environment. Achieving our operational targets while enhancing the business through further capital management initiatives, including the successful issue of Goodman+Bonds, has been especially pleasing.”

Capital Management

A suite of capital management initiatives have been undertaken in response to the unique economic and financial conditions that have existed since 2007. These initiatives continued during the year and were further extended with the offer of Goodman+Bonds.

This highly successful corporate bond issue received strong support from the investment market and raised $150.0 million. The issue diversified the Trust’s sources of debt funding and extended the weighted term of its credit facilities by almost a year.

Keith Smith said, “An important component in the success of the Goodman+Bonds issue was the investment grade credit rating from Standard & Poor’s. GMT’s issuer rating of BBB reflects the strength of the business, its investment strategy and the exceptional security provided by its contracted cashflows and high quality property portfolio.”

In addition to the issue of Goodman+Bonds, GMT has continued its disciplined capital management programme with two asset sales realising $53.3 million and an amendment to its distribution policy to retain up to 10% of operating earnings.

Keith Smith said, “Asset sales have been an integral part of the capital management strategy with over $100 million of successful transactions completed in the last two years.”

At 31 March 2010, net borrowings make up 37.0% of property assets compared to 35.3% the previous year. The level of debt is at the midpoint of the Board’s targeted range of 35-40% and well below the 45% maximum allowed under the banking covenants of GMT’s main debt facility.

Distribution Payment

The fourth quarter distribution is to be paid to Unitholders on 24 June 2010. The payment will include a cash component of 2.125 cents per unit, there are no imputation credits attached.

This final quarterly payment will result in a total cash distribution of 8.5 cents per unit for the year, a payout ratio of 93.4% of operating earnings.

Unitholders are reminded that the distribution reinvestment plan continues to operate with a 2% discount and that any changes to their election is required by 5:00pm on the record date of 10 June 2010.

Portfolio Performance

GMT’s sound operational result has been driven by the underlying performance of its property portfolio. High occupancy levels and modest rental growth together with the revenue boost provided by completed developments has helped ensure income targets were achieved and that the Trust delivered an operating performance consistent with forecasts.

Chief Executive of Goodman (NZ) Limited John Dakin, said, “This year’s solid operating result reflects the quality of the assets and the benefits of active management. GMT has demonstrated that it is a resilient business, maintaining its revenue streams and strong balance sheet position despite the subdued economic environment.”

Portfolio highlights include:

+ Leasing 114,326 sqm of rentable space to new and existing customers.

+ Securing over 28,900 sqm of new development commitments at M20 Business Park and Highbrook Business Park.

+ Achieving annualised average rental growth of 2.8% pa across all rent reviews.

+ Achieving an occupancy rate of 96% and a weighted average lease term of 5.8 years.

The Trust’s significant development capability has continually enhanced the property portfolio with over 50% of the assets developed or completed by Goodman over the last six years.

Further success in the development programme has reaffirmed GMT’s position as a leading provider of industrial and business space property. In a leasing market where there were few development opportunities, the Trust’s estates have continued to attract new business with design build commitments secured from Kmart, IBM NZ, and Ingram Micro New Zealand.

The three new facilities have a weighted average lease term of 10.8 years and provide a blended yield on cost of 9.0%.

Valuations

While the operational performance of the portfolio has been pleasing its investment performance has been marked by a relatively modest decline in asset values.

Independent valuations of the Trust’s investment and development assets reduced the value of the portfolio by 3.3% to $1.5 billion. The $49.9 million write down is an annual movement that compares with last year’s devaluation of $172.8 million (10.3%).

The 3.3% decline comprises a 1.6% reduction in the value of the investment portfolio and a 13.1% reduction in the value of the development portfolio.

John Dakin, said, “While the investment and development assets recorded a devaluation the Board has been encouraged by the stabilisation in the values of the investment portfolio since September. A 10 bps firming in the weighted average capitalisation rate is an indication that investor demand is strengthening for the high quality assets we invest in.”

The portfolio has a weighted average capitalisation rate of 8.6% at March 2010 compared to 8.7% a year earlier. Offsetting the strengthening capitalisation rate has been a 1.5% reduction in the independent valuers’ assessment of market rentals.

Outlook and Guidance

GMT’s sound operating result and strong balance sheet position show it is a robust business that has adapted to the joint challenges of a slower economic environment and a more restricted credit market.

The successful bond issue and other capital management initiatives undertaken during the year diversified the Trust’s sources of debt funding and have ensured it remains well capitalised.

While these initiatives have strengthened the business they have contributed to the decrease in operational earnings. The impact of increased interest costs, asset disposals and lower growth assumptions will continue to impact into 2011 where operational earnings are expected to range between 8.6 and 8.8 cents per unit.

This guidance assumes that operational earnings are not impacted by any changes in the taxation of property investments and that there is no unexpected deterioration in market conditions.

John Dakin, said, “A flexible strategy together with considered investment and financing decisions have enhanced the business and helped preserve Unitholder value through a period of uncertainty. GMT’s strong balance sheet and stable cashflows give us confidence that the Trust will continue to deliver consistent operating performances into the future.”

ENDS

Business Canterbury: Urges Council To Cut Costs, Not Ambition For City

Business Canterbury: Urges Council To Cut Costs, Not Ambition For City Wellington Airport: On Track For Net Zero Emissions By 2028

Wellington Airport: On Track For Net Zero Emissions By 2028 Landcare Research: ANZAC Gall Fly Release Promises Natural Solution To Weed Threat

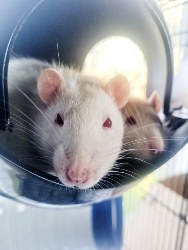

Landcare Research: ANZAC Gall Fly Release Promises Natural Solution To Weed Threat NZ Anti-Vivisection Society: Auckland Rat Lovers Unite!

NZ Anti-Vivisection Society: Auckland Rat Lovers Unite! University of Canterbury: $1.35 Million Grant To Study Lion-like Jumping Spiders

University of Canterbury: $1.35 Million Grant To Study Lion-like Jumping Spiders Federated Farmers: Government Ends War On Farming

Federated Farmers: Government Ends War On Farming